Chanel Miller said her New Year’s resolution for 2020 was to fail as much as possible.

“Making things that are really crappy and undeveloped until maybe they can be good. I’m way too young to confine myself to one lane and lose the ability to openly experiment.”

This is exactly how a the first draft of a film script develops. Characters and ideas float around in your head, and one day, they’re done with the floating and demand to live on the page. The script gets written, and when you’re done… it’s shitty. It’s embarrassing, you don’t want to show it to anyone, and you wonder how on earth your magical characters and ideas amounted to this pile of doodoo on the page.

But, it’s really important to have this first draft. Because as Miller said, yes, it’s crappy and undeveloped, but you need the crappy and undeveloped to have hope for the good and the great.

Struggling, wrangling, failing, crying, working, pushing forward allows your characters and your story to breathe, thrive, and for the bones to slowly emerge from the pile. Experimenting openly, taking the story in unexpected directions, adding or removing key characters, and messing around with no pressure allows the sparks of creativity that makes the script sing.

Every creator needs that messy time.

The same is true for startup creators. Ideas for a product form in your head over time, sometimes over years. Then one day, you’re ready to put it on the “page” — to code something, to craft something. And it may be a sloppy, messy ball of hair, mud, and hope. Don’t clean it up, polish, and shine it in order to raise money too early.

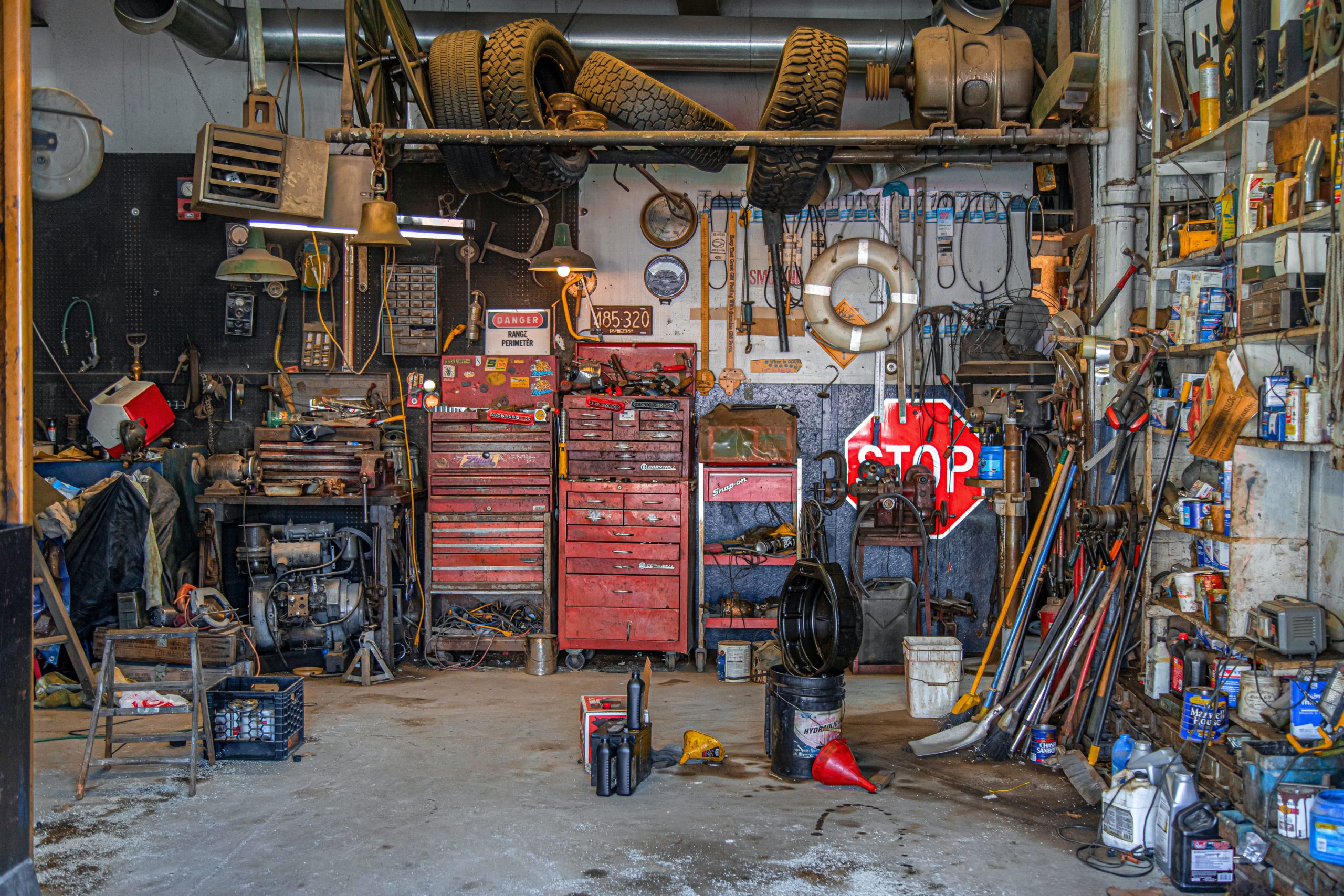

Love your messy stage, because it is so important to relish that stage. You can only do it once for each startup, and it’s when experimentation, ideation, hanging out, and trying weird things is entirely possible. It’s where ugly is awesome.

At some point, a screenwriter will have to share the script with producers. At some point, you have to share your startup with users and, if you want, with investors. If things go well, they love it, and you build an amazing company. Fantastic.

If you’ve grown your company into a wonderfully world-changing one, it’s worth finding ways to go back to being messy. Get into small groups. Make room for experimentation with ugly, creative things that may fail, because that can lead to new lines of growth. If you have the urge to start again, you could start another company and embrace the new ugly ball of mess. Whatever path you follow, the messy part of creation can be the the best part of creation, and the challenge of it makes your ideas and your company better.